Time to read: 8 min

It’s important for every new product introduction team to consider how to manage against risk in their supply chain, in order to avoid disruption. After you identify your high-level business objectives, I recommend four actionable strategies for supply chain risk mitigation:

- Dual/triple source for components where applicable

- Plan proactively against future scenarios

- Maintain visibility through the supply chain

- Negotiate with the intent of building sustainable partnerships

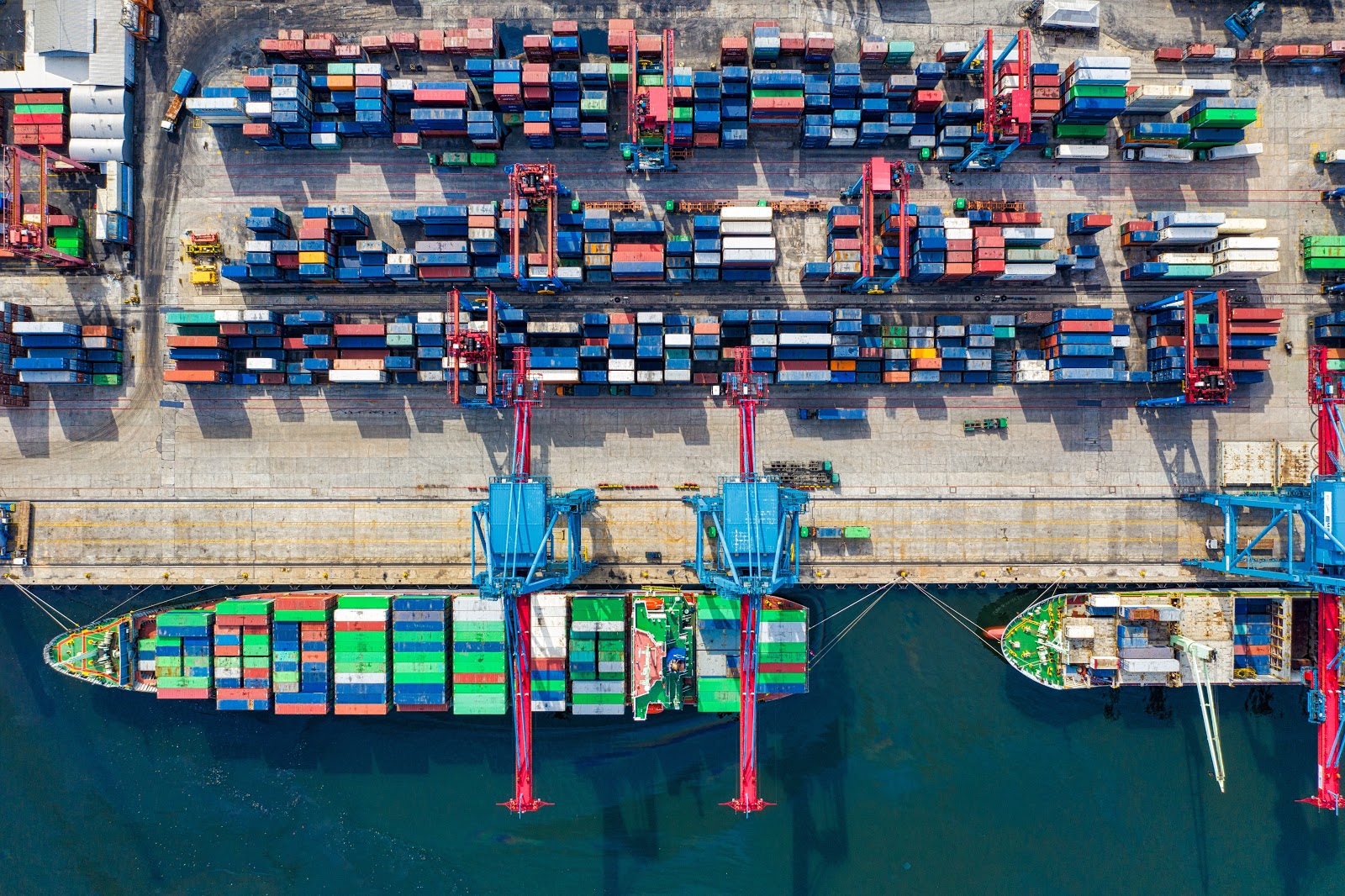

These supply chain planning strategies can shore up your business against unforeseen global supply chain disruptions. Supply chain disruption, which can be caused by unpredictable events such as trade wars, natural disasters, or health crises, is not new, so it’s essential to have plans in place to address it.

One example of supply chain disruption: COVID-19

In early 2020, the worldwide COVID-19 pandemic caused major disruption to the global supply chain. The shutdown of China and every company within the country for weeks rippled through the world.

Companies with March deadlines for major builds who were expecting critical components from Chinese suppliers to be delivered after Chinese New Year, in February 2020, faced long delays. According to the Institute for Supply Chain Management, lead times went up 200% or more across all supply chains and the entire world, disrupting businesses of all sizes.

Apple immediately changed their guidance to investors, explaining that they didn’t expect to hit their sales numbers because they lacked the supply to sell as many products as they thought they would. That was hugely significant for a company of that size. We can leverage our experience with COVID-19 and other disruptive events from the past, to plan more effectively for supply chain disruption moving forward.

Begin by identifying high-level business objectives

The alignment of high-level business objectives is key to implementing other risk mitigation tactics. The cost of not maintaining supply continuity is high, particularly for premium brands like Apple.

Therefore, in the case of premium tech brands and other high-margin, highly differentiated products in robotics and medical industries, it’s worth it to incur additional up-front costs to implement risk mitigation tactics. In these cases, it makes sense to dual or triple source components, hold high levels of inventory for hard to source components, and/or negotiate supply flexibility into your contracts, in order to avoid potentially fatal product shortages that could result in significant revenue losses and customer churn.

That’s different than, say, the toilet paper industry, where there is no premium brand, and brands don’t cost radically different amounts. In that industry, even when the supply chain is disrupted, it still doesn’t really make sense from a cost perspective to stockpile inventory or pay more for components.

More expensive, less lean tactics make sense for premium brands and industries with high margins, for whom the cost of not maintaining supply continuity outweighs the cost of higher inventory costs or supply chain costs.

Dual/triple source components, from multiple regions

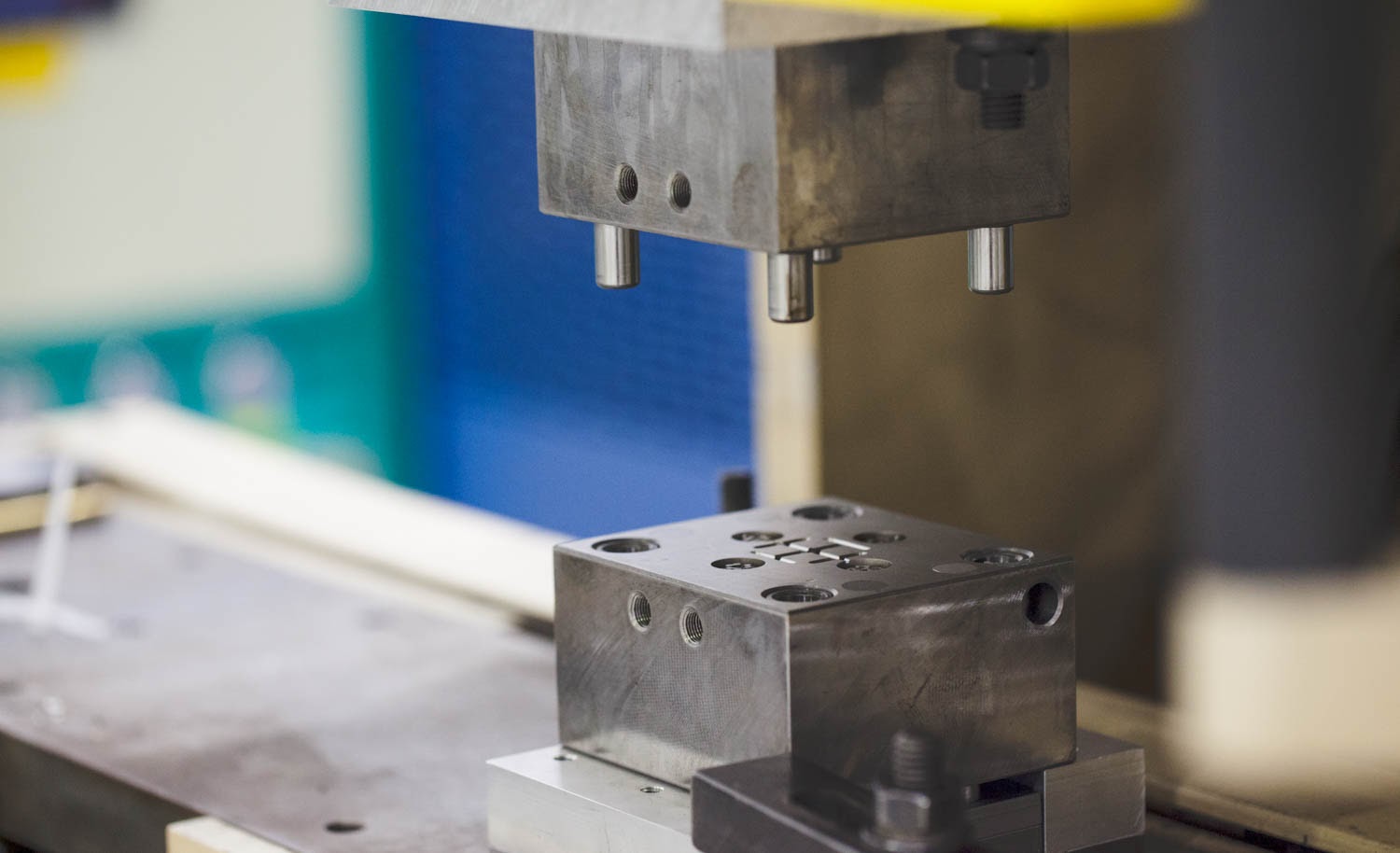

The second strategy that supply chain managers can employ to mitigate risk is dual or triple sourcing for components and doing so from multiple geographic regions. If you are producing 1,000 widgets a month of a critical component in aggregate, you can break that up and produce 250 at supplier A, 250 at supplier B, and 500 at supplier C, in order to reduce risk.

This strategy doesn’t come without cost. You’ll likely be paying a higher average purchase price for your components, and you’ll incur more overhead managing against those orders. But as long as the suppliers you have chosen are geographically dispersed (e.g., China, Taiwan, etc.); have flexible capacity; and you have discussed or pre-negotiated flexibility to scale production capacity, you’ll have significantly reduced your risk of supply shortages when disruptive events occur.

In the case of toilet paper, it’s commoditized, and suppliers operate on razor-thin margins. Differentiation in the market is around cost, not groundbreaking innovative features. There is no market for rolls priced at $25, so it doesn’t make sense to offer 5 factories around the world contracts to dual or triple source in case of a global pandemic. Toilet paper companies operate a lean supply chain, and therefore, they do not have the luxury of operating with high-cost tactics to guard against chance of supply disruption.

Using this strategy requires an analysis and classification of your product’s most critical and high-risk components. The components that are not already commoditized and easily accessible off the shelf or through multiple suppliers are the ones that are especially important to dual or triple source. It’s more important to optimize for continuity and supply than for inventory holding costs.

For extremely high-risk components, I recommend having multiple suppliers through whom you’re continuing production. That way, if you need to scale up supply through one supplier and lower it through another, there won’t be any lag time to start producing parts again. That’s a higher cost to qualify/manage multiple suppliers, but it’s important to weigh that with business-level objectives, which may outweigh the costs of not being able to maintain continuity of supply.

For instance, at China Manufacturing parts, we’ve worked with customers who cannot risk product shortages, and so we work on their behalf to strategically qualify and source production for critical components with suppliers in China, Taiwan, and the U.S. (each with their allocation of the entire production quantity). With this strategy, if one supplier has trouble scaling to the required production quantities, we can quickly reallocate volume to another, prequalified supplier.

I want to emphasize again that it’s important to have suppliers in multiple regions, not just multiple suppliers. Obviously, there’s higher risk in having suppliers in the same region—beyond pandemics, there could be geopolitical issues, increases in tariffs, or local disasters that damage infrastructure. Therefore, it is likely worth any costs you may incur to have a higher distribution of where your supply is, based on how it mitigates risk.

Plan proactively against future scenarios

We can’t make exact predictions about geopolitical unrest, tariffs, shortages of key materials, or natural disasters, so it’s crucial to plan for different scenarios and be prepared cross-functionally. Understanding what to implement in each type of disruptive scenario results in a faster response to supply chain disruptions. That’s what we mean at China Manufacturing parts, Inc. when we talk about supply chain agility.

It’s important to work through hypothetical scenarios with cross-functional leaders and their corresponding business-level goals, asking questions like, “How will we react? What is the timeline to implement? If we respond this way, how does this affect how we go to market? Will we meet our financial targets?”

Revisit scenarios quarterly and consider whether or not they still represent major threats to your supply chain. At China Manufacturing parts, with each new planning cycle (in half-year increments), we model out the capacity needs of our supply chain and the distribution of where those suppliers operate, to stress-test against a variety of scenarios.

For instance, China Manufacturing parts, Inc. looked at tariffs and geopolitical risks and decided to scout additional suppliers in Taiwan to prequalify and be able to work with when needed. They cost more than Chinese suppliers, but that’s slightly offset by tariffs coming out of China. When COVID-19 hit, and China Manufacturing parts’s China supply was disrupted, we started fulfilling through suppliers in Taiwan, with just a couple of days added to our on-demand manufacturing lead times.

Maintain strong partnerships and visibility through the supply chain

Your suppliers are an extension of your business and are key to your success. It takes time to build strong relationships, and you have to begin those efforts when things are going well, rather than under dire circumstances. It’s a constant effort.

To build strong partnerships, you need to have regular communication channels, whether they’re QBRs or weekly syncs. It’s important for you to provide visibility to capacity utilization expectations, performance feedback, visibility into your business objectives and supply flexibility. Likewise, it’s important for suppliers to provide visibility to capacity, visibility into their business objectives, and, during disrupting events, regular status reports and updates against open orders.

In order to further build and augment this visibility, it is also important to build the tools and systems that facilitate this real-time interchange of data. Supply planning system integrations, supplier portals, or well-designed and implemented blockchain supply chain solutions can provide you with the accurate, real-time visibility into your supply chain that allows you to make better and more agile decisions.

At China Manufacturing parts, we’ve built a proprietary portal where we communicate and securely share data with our network of manufacturing partners. This portal increases our visibility into order fulfillment and quality control so we can monitor and identify any potential issues as early as possible. It also helps us to standardize (and anonymize) the way design data is shared with customers as well as standardize quality inspection protocols, for improved efficiencies and quality results.

Clear communication with manufacturers who are your partners and an extension of your business is essential to know what they can and cannot support, moving forward. Clearly define those channels of communication. That’s what allows for supply chain agility at its finest.

Leverage healthy partnerships for negotiation

Just as building strong relationships with partners to increase supply chain visibility is important, it’s also essential to maintain a balance of give-and-take with suppliers and understand what is mutually beneficial for both partners, in order to build sustainable partnerships. It’s critical to understand your suppliers’ position and business goals, so you can find a mutually beneficial route forward (e.g., lower piece part price, but with better payment terms, to improve the cash flow for the business that is tight on cash) that also reduces risk of your supply chain (i.e., reducing the risk of losing a key supplier because they otherwise may go out of business).

In the case of a global pandemic like COVID-19, a company could gouge suppliers who are short on cash by asking them for rock bottom prices, but that could damage relationships, at best, and put the supplier out of business, at worst. Neither is good for your supply chain.

Instead, if you want lower piece pricing, you could approach that conversation by offering better payment terms. In situations when suppliers are short on cash, they may be willing to provide a discount on quotes, in exchange for shorter payment terms (e.g., NET15, instead of NET45).

For high-margin industries, that’s a win-win, because their cash reserves are enormous, and they have every incentive to keep suppliers and partners running to maintain continuity of supply. They get a better purchase price; their supplier gets better cash flow; and that mitigates some of the longer-term effects from supply disruption.

Main takeaways

Supply chain risk management strategies don’t come without cost, and for a lot of growing companies, the cost of dual/triple sourcing is untenable. That’s why we created the China Manufacturing parts Digital Manufacturing Ecosystem. Our entire business is built around developing strong relationships with suppliers around the world, and using technology for a more efficient and agile supply chain. You can plug into our ecosystem to benefit from dual/triple sourcing at a fraction of the cost.

Agility and resilience are more important than ever and worth the investment for companies with high-margin products. Companies must change the way they do things to be prepared for the future, in ways that align with company-level objectives. China Manufacturing parts, Inc. is here to help.